Ten employers who are self insured for workers’ compensation in California are about to face tighter financial scrutiny after a statewide actuarial peer review identified them as statistical outliers. Department of Industrial Relations’ Office of Self Insurance Plans says it will be doing a “deep dive” audit of the suspect companies’ workers’ comp claims files and required actuarial reports as a result.

OSIP is not releasing the identity of the ten self-insured employers as it is barred by statute from commenting on the finances of individually self-insured employers.

It is known that Barrett Business Services (NASDAQ: BBSI) recently took an $80 million hit to its pre 2012 reserves. It refused comment on the level of under reserving in California. It has indicated in public filings a need to increase its ability to borrow. It has not filed any information (as of late Sunday) regarding its borrowing line. It would not comment on the amount of reserve deficiency in California. Barrett and Kimco PEOs will have their permit to self insure terminated as the result of SB 863. Another temporary services company is pending.

OSIP cannot confirm or deny if Barrett is included among the 10 employers facing increased scrutiny.

OSIP chief Jon Wroten says the actuarial review examined the reports and claims data that self-insured employers or self-insured groups (SIGs) are required to file with the state. The goal was to see how companies compared to the self-insured community as a whole as well as to benchmark them against other self-insured employers in their own industries. One of the outcomes he says is that the review identified two key audit findings that are indicators of additional problems.

“The people that we’re really going to look very closely at are the people who fall out and have triggered both red flags,” says Wroten. At this point he isn’t identifying the audit flags but says the ten companies are the only ones that triggered both.

“When someone is triggering both they are way way outside the realm of reasonability,” Wroten says.

Wroten revealed the preliminary results at a meeting of SIG industry professionals. The very good news is he assured the crowd that none of the 26 active SIGs in the state were in this select group of ten troubled self-insured’s. This relieves the stress of the SIG members who are jointly and severally liable for each other’s claims.

But, based upon history employers who were in PEO with failed self-insured programs have been sued by the Self Insured Security Fund for unpaid claims. Until increased security is posted in the form of a surety bond or cash equivalents this remains a potential danger for employers who have been with BBSI during the affected periods.

Another self insured PEO, Kimco, also faces having its self insured permit terminated as of January 1st and is litigating the revocation.

Reserves, Actuar ial Estimate Gap

ial Estimate Gap

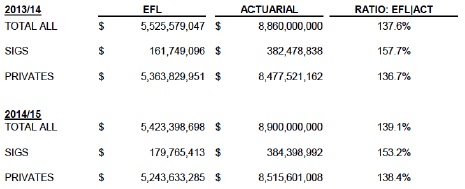

Beyond the ten outlier companies, Wroten says the actuarial peer review process revealed that average ratio of the actuaries’ estimates of liability to actual case reserves is currently at 1.39 for the self-insured industry as a whole but that there are significant difference between SIGs and individually self-insured employers.

Self-insured groups are running behind the self-insured industry’s rate at a 1.53 ratio, while individually self-insured employers are currently at a 1.38 ratio. SIGs actually have shown improvement during the first two years of reporting actuarial estimates of their workers’ comp liabilities. OSIP data shows that the SIG industry’s ratio was at 1.58 the first year post SB 863, while privates were at 1.37 (see chart).

Wroten told Workers’ Comp Executive that he is comfortable with the reserve ratio [overall] for the private self-insured’s and when pressed says he is comfortable with the SIG industry’s ratio as well. Still he maintains that the real benefit of the study results is still to come. “The more important aspect of these is the ability to assess and compare each individual self-insurer against the overall average numbers to understand how the individual self-insurer is performing in comparison to the self-insured community as a whole,” he maintains.

Overall, the estimated cumulative total exposure to workers’ comp liabilities for private self-insureds is at $8.9 billion while the industry as a whole has $5.4 billion in case reserves. Current case reserves for SIGs are $179.8 million compared to an actuarial estimate of $384.4 million.

The totals work out to an average case reserve of $30,329 for SIGs compared to $57,729 for all private self-insured employers.

“I can speculate a couple of different ways why there is a disparity there,” Wroten told the SIG administrators. “You’re not mirroring what the overall self-insured community is doing – this would imply that you’re doing much better than your private counterparts. That would be one presentation. The other presentation would be that you’re under reserved. You could make either argument but its speculation at this point.”

Whether its claims handling practices, industry exposure or some other combination of factors, SIGs are carrying a lower claims load than the rest of the self-insured industry.

OSIP data indicates that private self-insured employers have nearly 94,000 open claims for just over 2 million covered employees. The ratio works out to 1 open claim for every 22 workers which is twice the rate for SIGs in California. Overall SIGs have just under 6,000 open claims for 261,562 covered workers for a 1:44 ratio of open claims to workers.

One industry source speculated that the difference could be one of culture. “SIG’s often have a strong peer pressure to keep up with the other members and not to harm them,” he says. Another added that “the synergy within a SIG can do more to lower their losses through having ideas and solutions that a single employer might not otherwise.”

Stay tuned for additional information on SIGs and the self-insured industry as a whole as it becomes available.