By now, thanks to the general media, everyone knows that California Insurance Commissioner Ricardo Lara took money into his 2020 campaign – some $53k – from individuals related to Applied Underwriters. The evidence in the timeline of events strongly suggests that he took official actions – by changing or staying administrative law judges’ decisions to Applied’s benefit – after receiving Applied Underwriters’ money.

Correlation may or may not equal causation, but the proximity of his direct favorable actions in legal cases before the Department of Insurance raise the issue. What’s at stake is far more subtle and farther under the radar than the approval of the sale of Applied Underwriters’ and its affiliates, or the approval of rate filings for wildfire, or cannabis cultivation coverage, all of which are on Lara’s desk. It is about dozens of cases, a precedent, and hundreds of millions of dollars that Applied wants from California employers who may not owe it or who may be due refunds.

Because of Lara’s actions, clouds of corruption are now cast over the decision-making process of the Department’s Administrative Hearing Bureau– not the individual administrative law judges.

The Commissioner, by virtue of his office, sits in a judicial capacity. In these cases, involving Applied Underwriters’, not only did he have a financial relationship to one of the parties in the litigation, prior to making decisions, but he took official actions in the cases.

A Little Background

Last week the general media discovered that Lara had accepted contributions from persons related to Applied Underwriters. Since Lara had publicly committed not to taking insurance money, it became an issue. The media understood that Applied’s sale and other filings were before the Commissioner. Lara acts as his own treasurer and as such filed the reports identifying those donors in their jobs but hiding their relationships to Applied.

Lara’s promise not to accept and then his acceptance of money when issues are before him generated general media editorials demanding that the situation be looked into. Workers’ Comp Executive has been investigating and covering Applied Underwriters’ for several years – we’ve written some 75 articles on the topic. In full disclosure, we are obligated to say Applied even sued us – for allegedly violating their copyright – all the way to the 9th Circuit. We won the decisions at every step of the way.

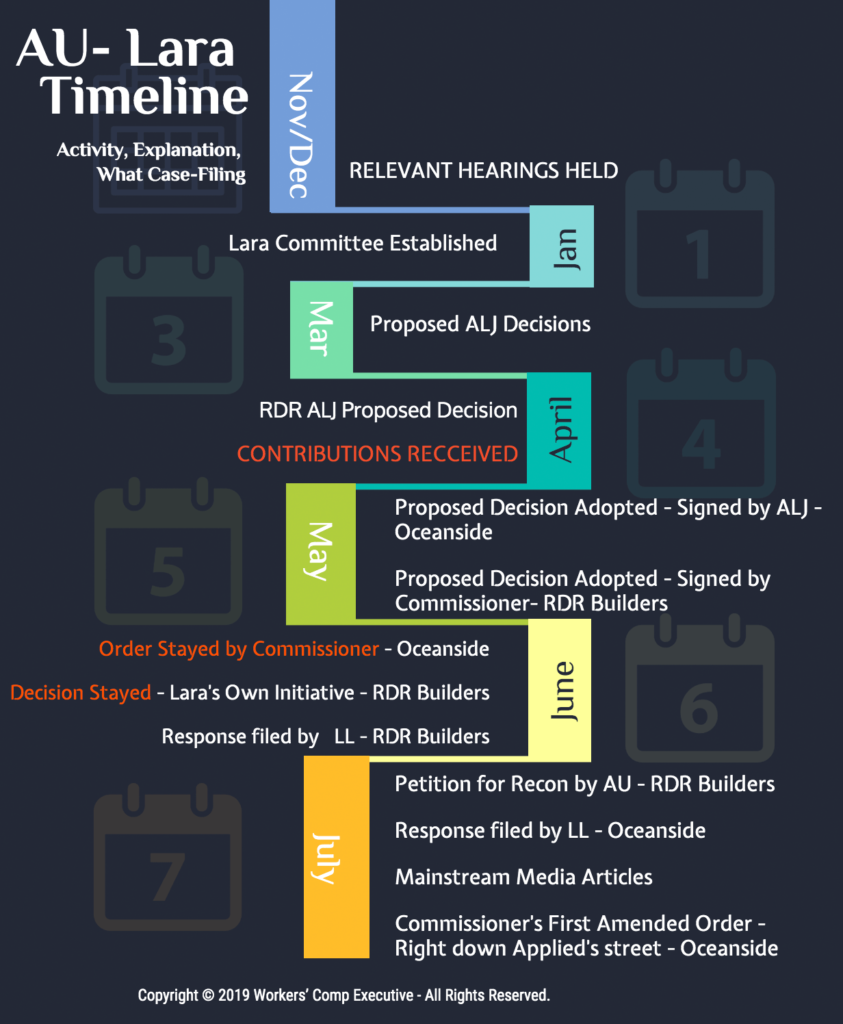

In light of the newest allegations, we knew where to look. We examined multiple legal actions before the Department’s Administrative Law Judges. We cover these kinds of cases, especially those involving Applied regularly. What we found is outlined in the timeline nearby. It is the story of specific decisions by Administrative Law Judges – which may ultimately affect those hundreds of millions of dollars – being stayed on the Commissioner’s own initiative, and later not adopted.

There have been tons of cases filed by employers against Applied Underwriters’ in all levels of state and federal courts around the country. They have one thing in common, and that is a fight over the amount of money Applied Underwriters’ asserts it is owed, or by Applied Underwriters’ back to the employers. It’s over what Applied sold as a loss sensitive program called EquityComp – using a contract known as the Reinsurance Participation Agreement, the RPA. The RPA has been determined to be void and unenforceable by multiple courts in multiple jurisdictions including by the previous California Insurance Commissioner.

In California, there are dozens of administrative law cases are being heard by the Department of Insurance involving Applied Underwriters’ EquityComp Program – and therefore presently before the Commissioner. The collective outcome of those cases is gigantic for individual California employers, and humongous overall for Applied Underwriters’.

The critical issues in these cases were in front of the Department at the time Lara knowingly accepted the contributions. After Lara took these donations, two decisions were stayed by the Commissioner, one at the sole recommendation of Lara. A delayed promise to return the funds after a media backlash does not change these facts.

The Timeline

The Timeline

The legal issues, in this case, are complicated although we’ve attempted to simplify them, perhaps overly. We have put the actual decisions in our Resources section – click here.

November / December 2018

As you can see by the timeline nearby, several relevant cases on point were heard at this point.

January 2019

Lara establishes his 2020 reelection committee with himself as finance chairman.

March 2019

The evidentiary records were closed by the ALJs, a normal process, and proposed decisions were issued. A proposed decision is the work of the ALJ, which goes to the Commissioner – Lara – for review. The employers do not see these until an action is taken.

April 2019

Lara receives the contributions to his campaign and deposits them.

May 2019

Commissioner Lara acting in his quasi-judicial capacity approved the Proposed Order and Decision by the ALJ in the matter of Oceanside Laundry. Seven days after that, the Commissioner approved the Proposed Order and Decision in the matter of RDR Builders.

It is routine for Commissioners to adopt the ALJ decisions and very rare when they do not.

What’s important is that each decision adopted the position that Applied had not proven any right to receive the benefits of the underlying CIC policy premiums and in RDR, was even more specific in stating that the Commissioner was leaving the issue of a remedy up to the courts:

“For avoidance of doubt, the ALJ makes no finding as to whether the guaranteed cost policies are valid or enforceable. There has been no allegation in the proceeding that the [CIC] policies are unenforceable on any grounds within the Commissioner’s jurisdiction under insurance code section 11737, subdivision (f).”

Applied was not happy with these decisions. They were a win for the employers essentially because it ordered Applied to pay back any monies the employer paid in excess of the face amount of the CIC policy. But more importantly, the ruling was against Applied because it didn’t give Applied what it wanted – the rights to collect any underpayments on the underlying policy. It had counted on the Department finding the [CIC] polices must be paid. Further, the decision left the issue of a remedy up to the courts.

June 2019

Lara’s questionable actions begin at this point.

On June 7th, Applied’s attorneys took the unusual step of filing a Petition for Reconsideration in the Oceanside matter. And five days later in an unexpected move and certainly out of rhythm with his previous actions, the Commissioner ordered the Oceanside decision be stayed. A few days after that, Lara – on his own initiative stayed the RDR order.

Applied argued, that it wanted to impose upon employers the cost of the guaranteed cost policies even if the employers hadn’t bargained for, approved, or paid for the terms of those policies which were provided to them under the voided RPA.

The employers responded arguing that they purchased a loss sensitive deal, not a guaranteed cost policy and that it would be improper to reward Applied for their “illegal conduct” and not require them to make refunds.

July 2019

Lara files an amended order in Oceanside on July 12th. It was a significant concession in Applied’s favor. What he did was to change the order from May to require employers to pay the total of the CIC policy. The order was you shall compute the premium based upon the guaranteed cost policy, which is precisely what Applied wanted.

And this point – the requirement to pay based the underlying policy that the employers didn’t buy or negotiate is what could make all of the hundreds of millions of dollars difference to Applied Underwriters’.

Oceanside and RDR are just two employers out of dozens whose cases will come before Lara in the near future. The troubling actions he has taken to date demand a thorough review and perhaps the consideration of new safeguards for policyholders in these disputes.

-30-

See our other stories about Applied Underwriters’ here

Applied Underwriters was once but is no longer an affiliate of Berkshire Hathaway. Applied’s management bought it. Berkshire Hathaway bears no responsibility for any of the events which have transpired involving Applied Underwriters’ or its subsidiaries including California Insurance Company.