The California Department of Insurance fully adopted the Workers’ Compensation Insurance Rating Bureau’s September 1, 2023, regulatory filing. A separate decision on the advisory pure premium rates is still pending.

The Bureau is a private organization with quasi-governmental responsibility. It is financially supported exclusively by insurance carriers in whose interests it operates.

Approval of this regulatory filing clears the way for employer X-Mods to be updated and increases the threshold for experience rating. The filing boosted the threshold from $9,200 to $10,200 to account, the Bureau says, for overall wage inflation.

The regulatory changes also create a separate, long-awaited lower rate for California’s 8871 telecommuter classification. The classification’s pure premium advisory rate has been tethered to the 8810 clerical classification since its creation. The premium charge for 8871 will be cut by 25% due to its lower losses and higher payroll compared to the 8810 classification’s experience.

BROKER ALERT: Remember to add the telecommuter class to employers with telecommuters.

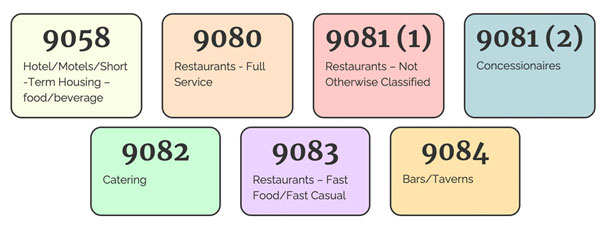

Approval of the filing also clears the way for splitting the 9079 restaurant classification into six new classifications. The new classes will take effect in about 15 months, on September 1, 2024. However, they will still be combined for rate-making purposes until the Bureau collects enough credible experience to establish individual class rates.

The new classifications include:

- 9058 Hotel/Motels/Short-Term Housing – food/beverage

- 9080 Restaurants – Full Service

- 9081(1) Restaurants – Not Otherwise Classified

- 9081(2) Concessionaires

- 9082 Catering

- 9083 Restaurants – Fast Food/Fast Casual

- 9084 Bars/Taverns

Workers’ Comp Executive will provide coverage of the rate hearing and decision when it occurs.